#17. The Retail Media Networks Gold Rush: The Next $130B+ Attention Economy

From barcodes to broadcast -- why smart money is pouring into the intersection of first-party data, closed-loop attribution, and retail-owned media channels

Retailers used to sell toothpaste. Now they sell ad space next to toothpaste, and it’s more profitable. Welcome to the $130B+ attention economy.

Recently, I attended a sharp, no-frills session on retail media networks (RMN) about pulling back the curtain on what actually works in this space. They’re having a moment, and for good reason. The session was eye-opening, but as I dug deeper afterward, I realized there’s a lot beneath the surface worth unpacking, especially for those navigating RMNs as operators, investors, or marketers.

Here’s a breakdown of what stood out, and my take on where this space is headed.

What Are Retail Media Networks?

Retail media networks are platforms owned by retailers that let brands advertise directly to shoppers using first-party data (e.g., Amazon Sponsored Products, Walmart Connect, or Instacart Ads). Although they’ve exploded in popularity in recent years because sitting at the intersection of intent, identity, and closed-loop measurement makes them lucrative, the promise and the execution aren’t always aligned.

Market Context: This Isn’t a Niche Anymore

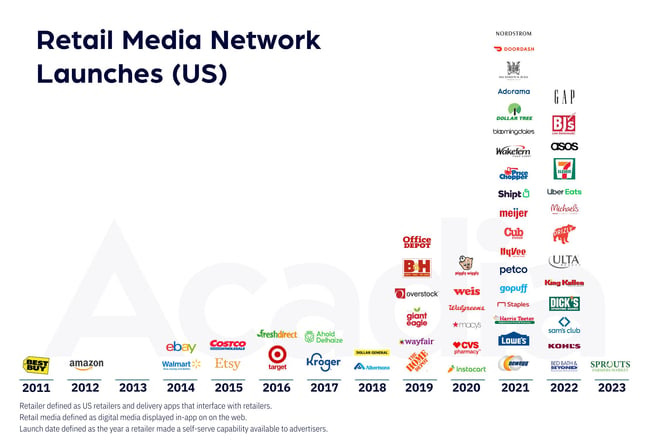

Here’s why all this matters: retail media is the fastest-growing ad channel in the U.S. U.S. retail media ad spend is projected to hit $130B by 2028, up from $55B in 2024. It’s not just the largest players like Amazon doing this either, everyone from Ulta to Petco is building some version of a media arm and trying to monetize their owned traffic and first-party data (see the exhibit above).

RMN ad spend is expected to experience double-digit growth until 2028. Annual retail media ad spend and % of total media ad spending:

Takeaways From The Talk

ROAS vs. iROAS: The Attribution Mirage

One of the biggest takeaways from the session was the growing disconnect between ROAS (Return on Ad Spend) and iROAS (incremental ROAS). ROAS is easy to measure but often misleading. iROAS is harder to calculate, but it tells you if your ad actually changed behavior; it measures actual lift caused by the ad, not just total attributed sales.

For example, if you’re advertising gas grills in May, you're probably not converting new customers. Instead, you're likely just pulling forward seasonal demand by nudging people who were going to buy one anyway. iROAS tells you that, ROAS doesn't. So yes, your campaign “worked” but did it move the needle?

Durable Goods ≠ CPGs: Don’t Use the Same Yardstick

The session drew a key distinction: durable goods (like grills or vacuums) operate on different logic than convenience items (like soda or snacks). For the latter, you might be stealing share. For the former, you might just be shifting purchase timing.

The implication is to not evaluate campaigns for durable goods using CPG metrics. You’ll get false positives and overspend.

Match Rates and Signal Gaps: The Veneer of Precision

Retail Media Networks are only as good as their match rate infrastructure, and not all retail categories are created equal when it comes to signal fidelity. In high-consideration categories like mattresses or laptops, user journeys leave strong, traceable signals (logins, saved carts, repeat visits, etc.). For high-velocity categories like gum, soda, or OTC meds, on the other hand, shoppers often remain anonymous. No login or entering their loyalty card at the checkout station, no trail. Just a tap-and-go purchase.

If a retailer’s first-party data can’t map cleanly onto DSP-level identity graphs, everything downstream from targeting to attribution to personalization becomes shakier. Especially in impulse-driven verticals, the risk isn’t just lower performance; it’s false confidence driven by extrapolated assumptions.

Even though identity stitchers like LiveRamp and Trade Desk try to bridge the gap across walled gardens, devices, and cookie-less environments, even the best integrations are still probabilistic.

Granularity vs. Brand-Level Metrics: Attribution Is a Moving Target

In theory, retail media offers pixel-level granularity, so you run a promo on Cholula Jalapeno & Poblano, and you measure the uplift in sales. Simple, right? Not quite. What if that promo also boosts sales of Cholula Original? Or drives a halo effect across the whole McCormick portfolio? Maybe it subtly shifts consideration toward the brand, even if the shopper buys a different SKU later.

This is the attribution gray zone: Where does the influence end, and where does ambient brand equity take over? Retailers often push SKU-level precision, but in reality, promotions create blended effects, cross-SKU, cross-channel, even cross-brand. That’s why many brand teams zoom out and evaluate ROI at the brand or portfolio level. Measurement frameworks need to evolve so that brands don’t get lost in a sea of SKU-level noise while retailers chase impression-level granularity.

Some Additional Thoughts

The Pillars of RMN Maturity

After the talk, I couldn’t help but think about how one might evaluate a retail media network, especially from a product or investment lens. Here are some thoughts inspired by the gaps I noticed in the talk, presented as the SAM Framework:

Signal Quality

Does the RMN have rich, permissioned data that is identity-resolved (vs. tied to device IDs)? Is loyalty program usage high?

Do they capture omnichannel behavior (online, app, in-store)?

How often is the data refreshed and how deep is the behavioral context behind the data?

Example: Amazon benefits from logins (you must login to make a purchase), frequent purchases, and media consumption data. Conversely, a traditional grocer without app adoption will struggle with targeting and personalization.

Activation Flexibility

Can advertisers activate the available data across channels and formats (e.g., online, offline, connected TV)?

How much audience segmentation is possible in targeting?

Self-serve capabilities through DSPs and not just managed service (i.e., giving advertisers the dashboard, not just the report)The most sophisticated

RMNs allow marketers to treat them like full-fledged media platforms and not just fancy shelf space.

Measurement Rigor

Can it prove incrementaity (iROAS through A/B testing or otherwise)

Does it enable access to clean rooms

Track both SKU-level lift and brand-level halo effects

Moats: What Makes an RMN Defensible?

The retail media networks space is dominated by Amazon, followed by Walmart, with the remaining ~16% of the market being extremely fragmented.

If every retailer is launching an RMN, what stops this from becoming a race to the bottom? From my perspective, the defensibility of an RMN comes down to signal quality + brand trust + measurable ROI:

Proprietary identity: Login-based data, loyalty programs, and credit card partnerships give retailers clarity into who is buying what.

High-frequency categories: On one hand CPG-type goods (such as pet care, beauty, and grocery) may be difficult to apply marketing metrics to, on the other hand, the faster purchase cycles improves retargeting precision and speeds up feedback loops.

Offline + online integrations: Can the RMN bridge the physical-digital divide/drive foot traffic via digital campaigns or vice-versa?

Measurement IP: The best RMNs are investing in internal data science teams and clean room integrations to differentiate based on truth, impact, and measurable ROI, not just targeting.

Category Ownership: For example, Chewy or Ulta owning the pet/beauty verticals.

Case Study: Walmart x Vizio

Overview

As I sat in that talk, my mind wandered back to Walmart’s $2.3B acquisition of Vizio in 2024. Vizio is a smart TV maker with over 19M active accounts (growing ~400% since 2018) and a growing advertising business through its SmartCast TV operating system. The company enabled users to stream content for free by watching ads. This was a retail media land grab.

The Why: Retail Media Is a Data + Attention Business

Walmart already runs Walmart Connect, its in-house RMN. But to grow, it needs to own more consumer attention, not just where people shop, but where they spend time.

Enter: Connected TV (CTV). With Vizio:

Walmart gains a direct channel into consumers' living rooms, competing with Amazon’s Fire TV, Roku, and Google's Android TV. For example, Amazon (Walmart’s biggest competitor in RMN and maybe even retail) already owns Fire TV + Prime Video + Twitch + Freevee, all rich with viewing data. Now Walmart can also say that they’ve got the viewing behavior + shopping receipts + ad attribution.

It acquires Inscape, Vizio’s ACR (Automatic Content Recognition) data platform, which tracks what people are watching across platforms. This allows for:

Full-funnel attribution where Walmart can connect ad exposure on TV to actual purchases in-store or online (e.g. if someone sees a CTV ad for Old Spice and buys it at Walmart). This makes closed-loop measurement on CTV possible.

Enhanced targeting precision whereby blending Inscape’s viewing data with Walmart’s shopping data, they can create incredibly specific segments (e.g., people who watched Top Chef and bought organic groceries in the last 30 days, or families who stream Disney+ and purchase diapers monthly)

Omnichannel audience insights where Walmart gains an improved real-time read on consumer attention across media formats which strengthens Walmart Connect’s CTV ad offerings, informs media mix modeling and incrementality testing, and helps brand plan smarter cross-channel campaigns.

Optimization and refinement of campaigns across media types (banner, TV, app, email, etc.) from a single RMN

What This Means for Brands

CPGs can now run CTV ads with Walmart and track ROI like they would a Google ad.

Bundled ad packages will blur digital and TV, e.g., “Buy SmartCast CTV + Walmart.com + in-store screens.”

Expect Walmart Connect to launch self-serve TV ad placements soon.

Conclusion: Retail Media Is No Longer a Side Hustle But the Strategy

The landscape is evolving fast. Third-party cookies are crumbling. Advertisers are demanding provable ROI. Retailers need new margin engines. RMNs sit at the intersection of all three.

Retail Media Networks aren’t just monetizing attention. Rather, they’re redefining what it means to be a retailer. When media margins outstrip merchandise, the game has changed. You’re no longer in the business of selling stuff. You’re in the business of selling signal, access, and influence.

But not all RMNs are created equal. The winners will own the full stack:

High-fidelity data

Flexible activation channels (onsite, offsite, CTV, in-store)

Measurement that brands trust

So if you’re a brand or a VC evaluating this space, ask the sharp questions:

What signal are we really capturing?

Can we activate it without friction?

Can we prove it worked beyond a vanity metric?

If the answer is no, you’re not buying precision that will generate incremental business value; you’re buying performance theater.

So here’s what I think will happen in the next 10 years. The future belongs to those who don’t just sell stuff, but engineer signal. This isn’t a side hustle, it’s the infrastructure layer that serves as the connective tissue between content and commerce. And just like AWS quietly became Amazon’s most profitable engine, Retail Media Networks will become the backbone of modern retail for those bold enough to build it right.

Insightful and detailed review of a beyond-emerging advertising category. Great summary of the major players, trends, and future of RMN.